Year-End 2021

National Housing Market Analysis

National Housing Market Analysis

While the effects of the pandemic are still being felt across the country, 2021 proved to be a productive year in terms of economic recovery for the United States.

GDP rebounded strongly in Q4 following disappointing Q3 results that reflected weak consumer spending based on growing inflation concerns, supply chain issues, and the mergence of the COVID-19 Delta variant. Advanced Q4 GDP estimates put annual growth at +6.9%, up from just +2.3% growth in Q3. Per the Bureau of Economic Analysis, the acceleration in GDP growth was driven by an increases in exports and private inventory investments.

The U.S. employment situation improved throughout the year, adding more than +6.2 million jobs back to the economy from January to December, and the current unemployment rate stands at just 3.9% (considered “full employment”). It’s important to remember, however, that a significant number of people left the workforce entirely following the initial onset of the pandemic, and there are currently -3.6 million fewer people in the workforce today than there were in February 2020. When you consider these workforce losses in conjunction with those that remain under-employed, the real unemployment rate is closer to 7.3%.

“More homebuilding is coming but patience is required. Governmental delays and labor shortages are not new problems for the homebuilding industry, but these legacy challenges have only gotten worse over the past 20 months. Those plus supply chain disruptions are wreaking havoc on development timelines.”

Ali Wolf

Chief Economist, Zonda

From a housing perspective, 2021 brought a bit more normalcy to the market following the record-breaking stats produced in 2020. The construction and buying frenzy that gripped that market in the second half of 2020 diminished gradually through the first half of 2021 before stabilizing near the 20-year average for the latter part of the year.

Major factors that underpinned the U.S. housing market in 2021 are summarized below:

Normalizing Housing Market: After several consecutive quarters of unprecedented growth in home sales and construction, the housing market retreated to more sustainable levels during 2021. Rapidly increasing prices and low housing inventory worked to cool demand, especially from the first time and first move up homebuyer segments, and the increase in housing completions improved new home supply from record-low levels established in the beginning of the year. Builder Confidence is currently lower than the all-time high established in November 2020 but remains well above pre-pandemic levels.

High Home Prices & Declining Affordability: Critically low inventory, high demand, and increasing material costs all contributed to accelerated home price growth in 2021. High construction costs are adding approximately $36,000 to the base cost of a new home, and steadily increasing mortgage rates are adding hundreds of dollars to monthly mortgage payments. Additionally, critically low inventory of existing homes has created a hyper-competitive buying environment that has resulted in 33% of buyers paying more than the asking price for their home. New and existing home prices increased by +14.1% and +14.9% in 2021, respectively, and the Housing Affordability Index declined by -12.4% over this period.

Persistent Supply Chain Issues: The supply chain issues that evolved as a symptom of the pandemic’s initial onset last year have unfortunately persisted, and in some cases worsened, over the last 12 months. Lumber mill production continues to lag demand from the homebuilding and remodeling industries, and recently increased tariffs on Canadian lumber have exacerbated both supply and pricing issues. Builders continue to report shortages of materials ranging from copper wiring to appliances and windows, and these shortages are resulting in elongated construction times (3-6 months) and higher construction costs (+19% YoY).

The data provided in the following report has been interpreted and analyzed through the lens of residential development and home construction. Understanding key metrics and their implications is essential to making informed decisions and remaining flexible as a business, especially during these unprecedented times.

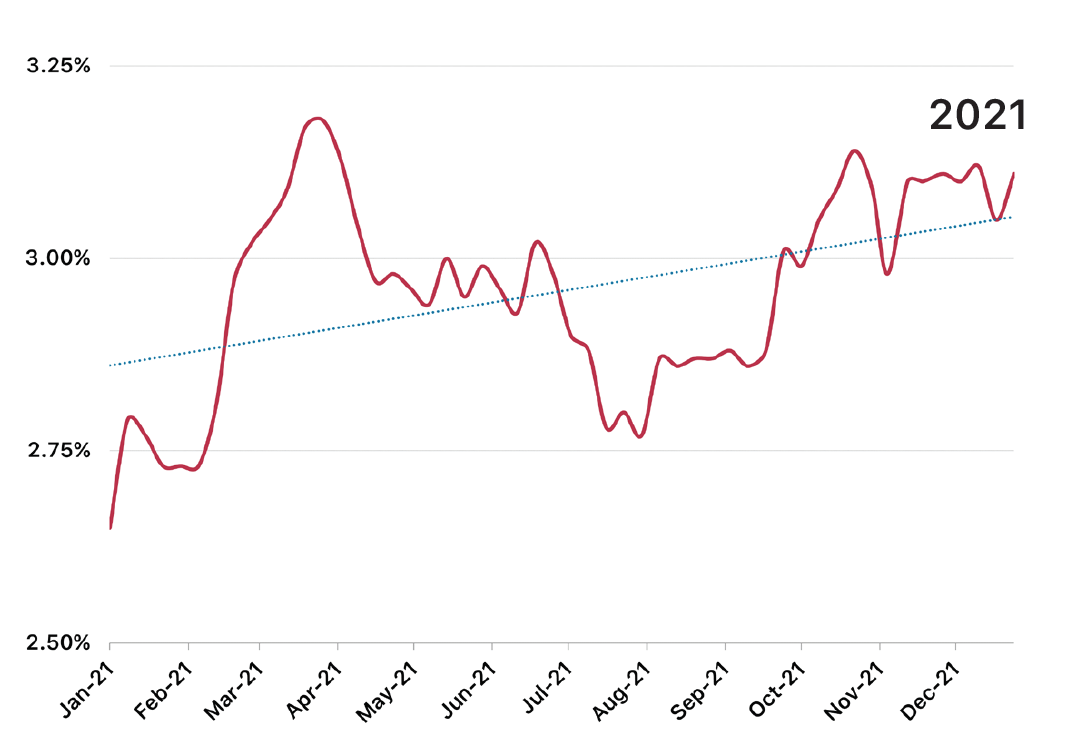

Mortgage Rates

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

Mortgage rates increased steadily throughout 2021 after reaching all-time low levels in 2020. 30-year mortgage rates closed out the year at 3.11%, an increase of +16.5% over the last 12 months. A rate of 3.11% is still well below the 20-year average (4.74%), but rates are expected to increase further in 2022 based on statements from the Federal Reserve indicating multiple rate hikes in the year ahead to combat growing concerns around inflation. This could result in an uptick in home-buying activity in the early part of 2022 as potential buyers look to lock in low rates before it’s too late.

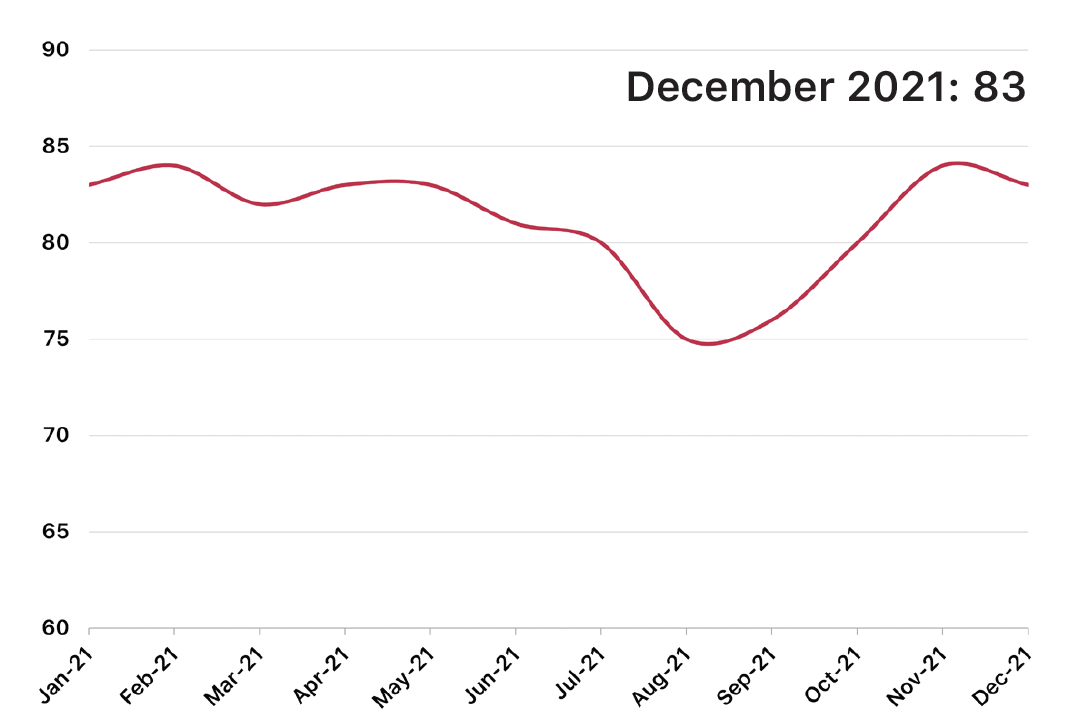

Builder Confidence

Source: National Association of Homebuilders, Wells Fargo

During 2021, ongoing supply chain and labor issues brought Builder Confidence down from the record-high levels established at the end of 2020. The index dropped as low as 75 in August but rebounded quickly during the fall and winter months as strong summer demand eased and builder pipelines relaxed. Builder Confidence ended the year at 83, and we expect continued volatility in this index over the coming months given that solutions to supply chain and labor issues are still being determined.

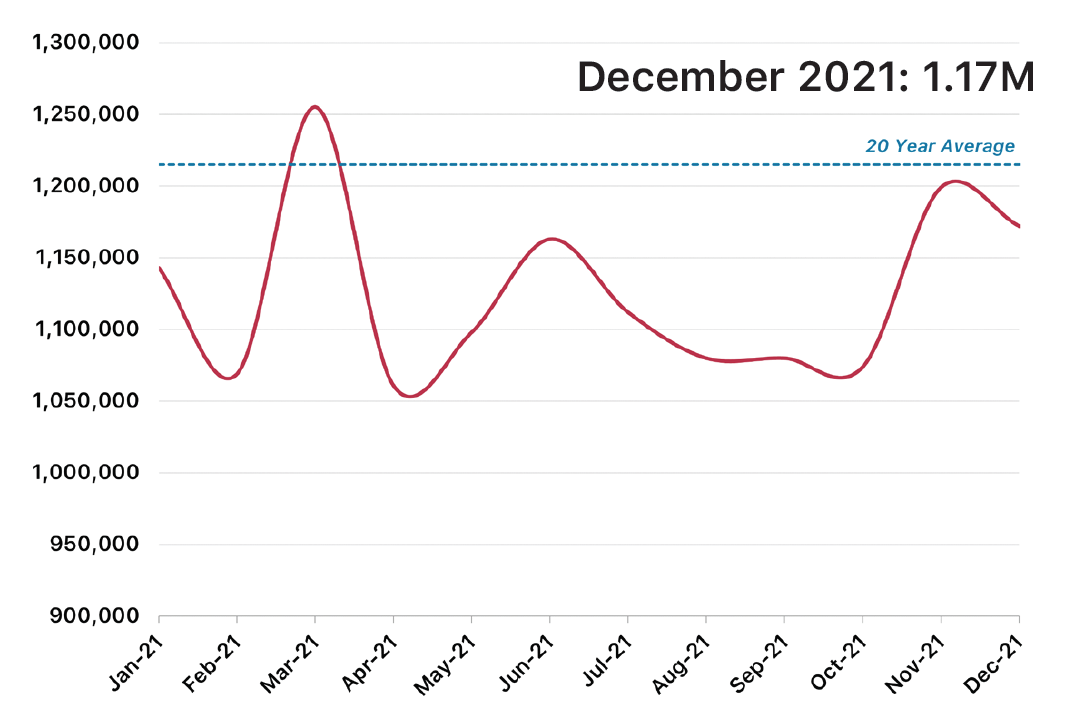

Single-Family Housing Starts

Source: U.S. Census Bureau

It’s important to remember that the -10.9% decline in housing starts over 2021 is not a reflection of diminishing demand, rather a result of builders intentionally limiting their starts and new home sales for reasons ranging from lot inventory preservation to limited availability of construction materials with which to build new homes. We expect that starts will continue to lag demand (and need) for the foreseeable future given ongoing supply chain, labor, and inventory issues, however we anticipate that persistent demand will push annual starts higher than what we saw in 2021.

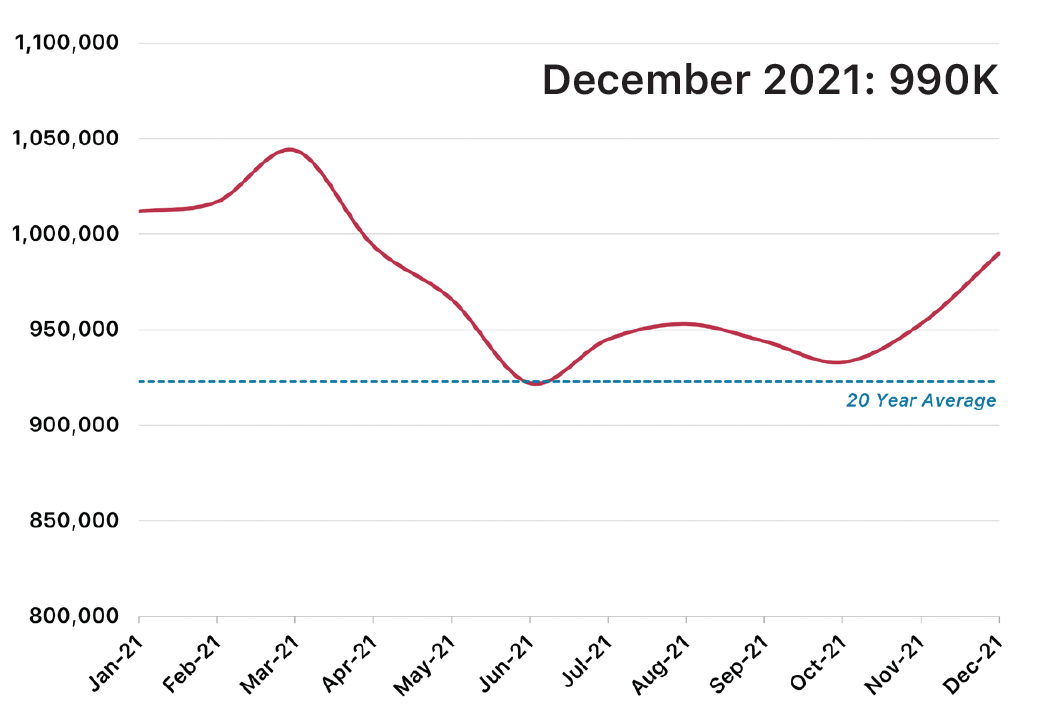

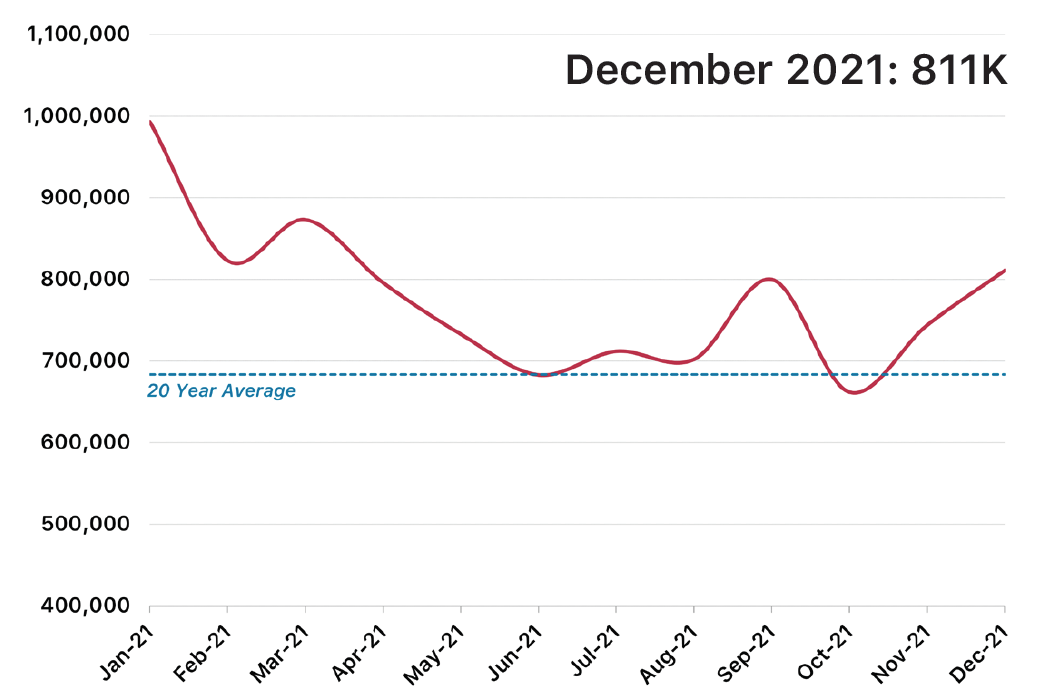

New Single-Family Home Sales

Single-Family Home Completions

Source: U.S. Census Bureau

The first three months of 2021 set records for new single-family home completions as builders began delivering new homes ordered during 2020’s buying frenzy. Completions declined after Q1, however, as supply chain issues made essential construction materials hard to come by and extended construction times between 3-6 months. It’s important to note that completions remained above the 20-year average for the entirety of 2021, and we expect completions to remain elevated through 2022 given the substantial backlog that most builders are still facing.

Source: U.S. Census Bureau

New single-family home sales returned to more normal levels in 2021 as compared to 2020 with annual sales declining by -14.0% over tthe last 12 months. This backslide in new home sales is a result of increasing affordability concerns, a lack of finished home sites suitable for new home construction, and the intentional restriction of monthly sales by builders. We expect that new home sales will continue to be impacted by inventory and pricing issues through 2022 but remain relatively high based on continued demand.

Median Sale Price: Existing Homes

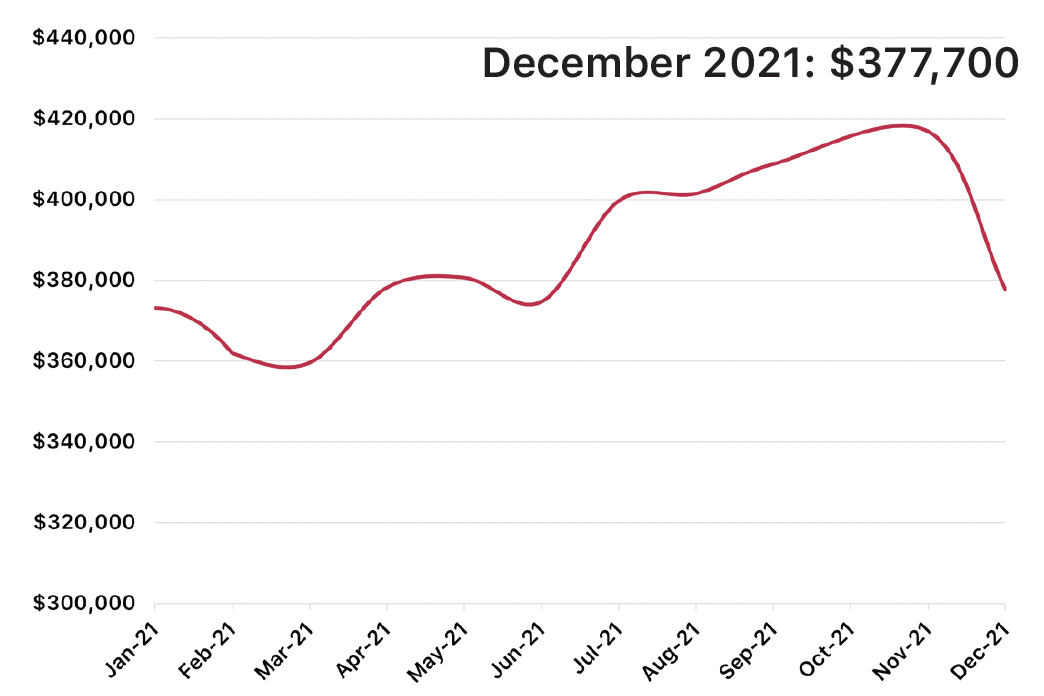

Median Sale Price: New Homes

Source: U.S. Census Bureau, National Association of Homebuilders

Before nose-diving in December, the median sale price for new homes was on track to increase by +14.1% during 2021. New home price growth is being driven largely by supply chain and material pricing issues, which are adding more than $35,000 to the base cost of the average new home, as well as continued demand from potential home-buyers. With no solution in hand for these concerns, we expect new home prices to rebound from the low December figure and continue their upward climb.

Source: National Association of Realtors

The median sale price for existing homes increased by +14.9% during 2021, the largest single-year increase ever recorded. High prices are being driven mostly by the extremely low supply of existing homes available to purchase, and while we expect that the median sale price for existing homes will continue to increase through 2022, recent data indicates that the rate of growth will return to more normal levels as COVID-19 concerns ease and additional inventory comes online.

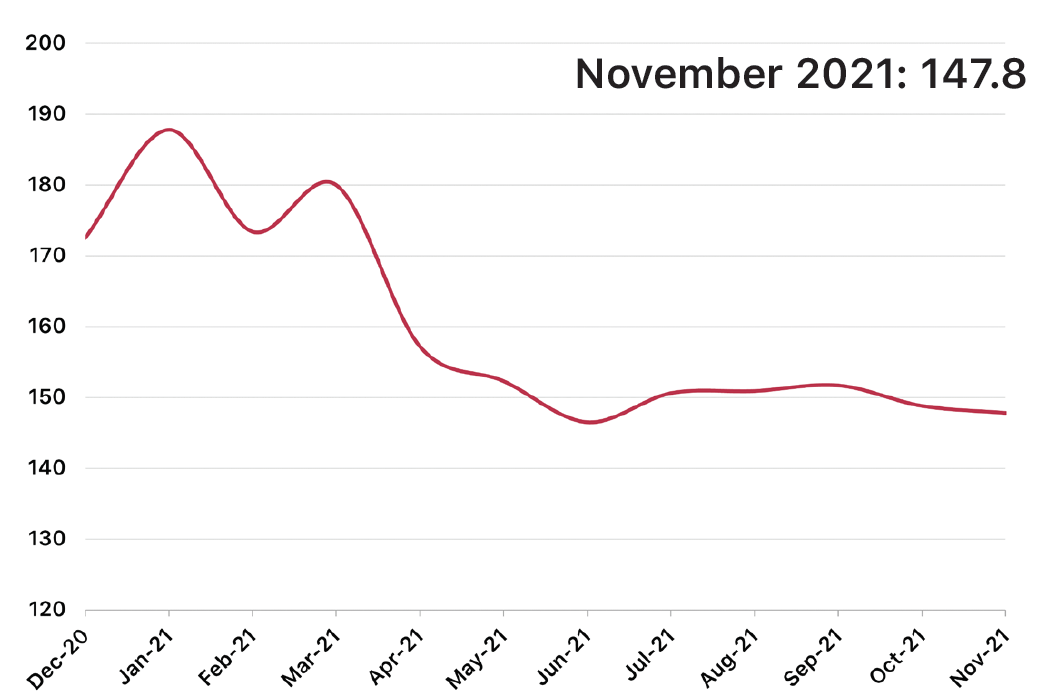

Housing Affordability

Home Price Index

Source: Standard & Poor’s

The Case-Shiller Home Price Index increased by +17.3% over the 12-month period from December 2020 to November 2021 (most recent data available), driven by low inventory of both new and existing homes and increasing construction costs for new homes. While we expect the Home Price Index to continue its upward climb through 2022, we anticipate that the rate of growth will return to more normal levels as additional inventory is added and supply chain concerns are alleviated.

Source: National Association of Realtors

Housing Affordability dropped steadily through the first half of 2021 before leveling out in the second half of the year, ending November (most recent data available) -14.3% lower than December 2020 levels. Housing Affordability will continue to be a concern so long as inflation and home price growth continue to outpace wage growth. Declining affordability has the heaviest implications for the first time and first move-up homebuyer segments, which combined to account for the majority of home sales.

New Home Supply (Months)

Source: U.S. Census Bureau

Rising prices, declining affordability, and restricted monthly sales helped move the New Home Supply closer to normal levels during 2021, increasing by +57.9% over the last 12 months. Steady demand will likely keep the supply of new homes near or below the 8-month benchmark during 2022, especially in the peak spring and summer selling seasons, but easing supply chain concerns and more moderate price growth should work to keep supply levels above the historic lows established in 2020.

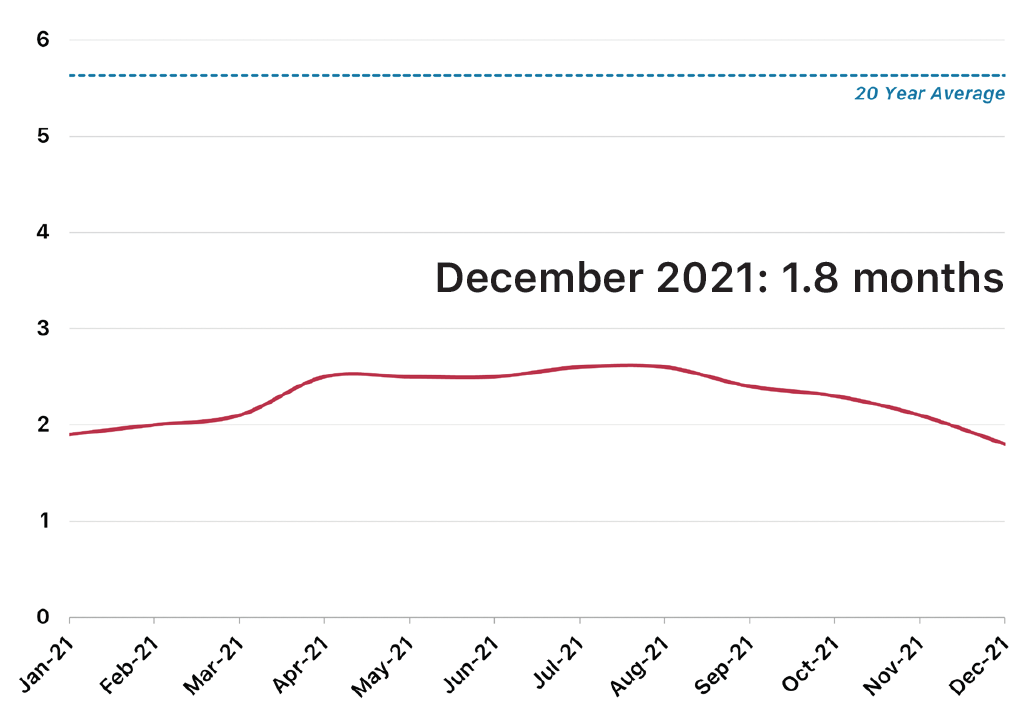

Existing Home Supply (Months)

Source: National Association of Realtors

The existing home supply declined further in 2021, finishing the year at a record-low level of just 1.8 months. Ongoing concerns around COVID-19 infections have suppressed additional homes from coming on the market, and the combination of high prices and low inventory has made it more attractive to stay in place and refinance rather than purchase a new home for many prospective buyers. Although we expect existing home supply to remain well below long-term levels for the foreseeable future, we anticipate that it will rebound above these historically low levels during 2022.

Conclusion

Despite the myriad of challenges faced by the economy over the last 12 months, 2021 will go down as an overwhelmingly positive year for the U.S. housing market.

Strong demand from the second half of 2020 carried into 2021, propelled by the Work-from-Home movement and millions of Millennials reaching peak “home-buying” age – both of which will continue to drive demand and home purchases for the foreseeable future. And although builders were confronted with materials and labor shortages, cost increases, and inventory issues through most of the year, they still delivered 30,000+ more homes in 2021 than they did in 2020.

The Federal Government and industry organizations are working together to find solutions to some of the persistent issues impacting new home construction, and the most recent metrics indicate that the overall housing market is recalibrating to more sustainable levels of activity. This should allow builders to deliver on their backlogs and relieve some of the pressure brought on by critically low inventory levels of both new and existing homes.

“Affordability challenges will keep prices from advancing at the same pace we saw in 2021 even as ongoing supply-demand dynamics mean prices continued to grow nationwide.”

Danielle Hale

Chief Economist, Realtor.com

Increasing Prices and Declining Affordability – Rising home prices are generally an indicator of a healthy, expanding housing economy, but they become an issue when price growth outpaces wage growth like we are seeing in today’s market. In addition to rising construction costs, steadily increasing interest rates, which are expected to increase further in 2022, are adding hundreds of dollars to monthly mortgage payments. Because there is no short-term solution in hand for the issues that are driving this unprecedented price growth, namely low inventory and supply chain bottlenecks, we expect that prices will continue to climb and affordability will continue to decline during 2022.

Low Home and Lot Inventory – The pandemic-induced home buying frenzy has shined a bright spotlight on the fact that the U.S. more than a decade ago. has been under-delivering both finished lots and new homes since coming out of the Great Recession. Finished home inventory was quickly gobbled up in the second half of 2020, and most builders found that their existing finished lot inventory was no where near substantial enough to keep pace with the sustained demand in 2021. Lot development across the U.S. ramped up significantly in 2021 to combat this issue, but 12+ month development times are not providing the short-term relief that builders so desperately need, and most of the lots currently under development are already spoken for by builders and therefore won’t provide much of a boost to the finished lot inventory.

Easing Labor and Supply Chain Bottlenecks – The diminishing effects of the pandemic should lead to a rebound in construction labor. According to the NAHB, there are currently more than 400K construction-related job openings, and an additional 350K openings will need to be filled this year to accommodate retirements and those otherwise leaving the industry. While supply chain issues and associated price increases won’t disappear overnight, they are expected to ease significantly by the second half of 2022 with sustained increases in production of scare items like softwood lumber and improving wait times at U.S. ports.

“All markets are seeing strong conditions, and home sales are the best they have been in 15 years. The housing sector’s success will continue, but I don’t expect 2022’s performance to exceed 2021’s.”

Lawrence Yun

Chief Economist, National Association of Realtors

For information about market research & reporting, including custom market reports, please contact Katie Fidler at katief@stbourke.com.