Atlanta: 3Q2022

Housing Market Analysis

Atlanta Housing Market Analysis

During Q3, fluctuations in Atlanta’s economy largely mirrored those fluctuations we saw across the national economy, and the “mixed signals” we’ve gotten over the last three months have brought about an increasing level of uncertainty and anxiety about the challenges that lie ahead. Despite sticky, albeit declining, inflation and rising consumer costs, the Atlanta economy continued to strengthen during Q3, adding +26,300 jobs over the last three months (+108,100 since the start of the year). Despite growing concerns of a potential recession on the horizon, several large corporations announced major Atlanta relocations and expansions during Q3, including a considerable expansion of Twitter’s Atlanta HQ, the development of a $2.3B lithium-ion battery plant, and the development of a $600M semi-conductor factory. Additionally, Atlanta delivered a record level of industrial space during Q3 and delivered more office space that it has since 2001. Much like the national economy, the Atlanta economy can be viewed as a partially-filled glass, and there is evidence to support both optimistic and pessimistic views of what the coming months will bring.

Atlanta’s housing market contracted further during Q3 as persistent inflation, high home prices, and increasing mortgage rates continued to erode both homebuyer and homebuilder confidence. The major factors that drove Atlanta’s housing market in Q3 include:

Affordability: High home prices and increasing mortgage rates continued to impact potential homebuyers during Q3, both from a financial and psychological perspective. Waning demand has led to a deceleration in home price growth in recent months, but prices across the Metro area remain elevated due to low supply and persistent demand from more affluent buyers.

Builder Slowdown: Builders have responded to waning demand by reducing the rate of both new lot production and new home starts. While these efforts will work to reduce their short-term risk by limiting the amount of inventory on the books, this pullback in lot and home production will only work to deepen Atlanta’s critical undersupply of available homes and finished lots once prices stabilize, interest rates come down, and demand returns.

Low Supply: While the total supply of active listings (new & resale) improved slightly to 2.1 months at the end of Q3, the supply level remains well below what is considered “normal” for this market (6-8 months). Given that 80-85% of all home sales are existing homes, this critical inventory shortage is working to prop home prices up despite diminishing demand.

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, Atlanta Association of REALTORS, Atlanta Business Chroncicle, Colliers, Zonda/Metrostudy.

Mortgage Rates

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

Mortgage rates appeared to be relaxing slightly through the first part of Q3 but quickly changed course following late July’s 75-basis point increase to the Fed Funds Rate. The Fed instituted two rate hikes during Q3 (July & September) totaling 150 basis points in an aggressive effort to curb inflation, which ultimately pushed the 30-year mortgage rate to 6.70% at the end of Q3 (highest level since July 2006). This uptick in interest rates is adding an estimated $259 to the monthly mortgage payment of a median-priced home, which translates to an additional +$3,100 per year and +$93,100 over the life of the loan (varies by lona term, state, and market).

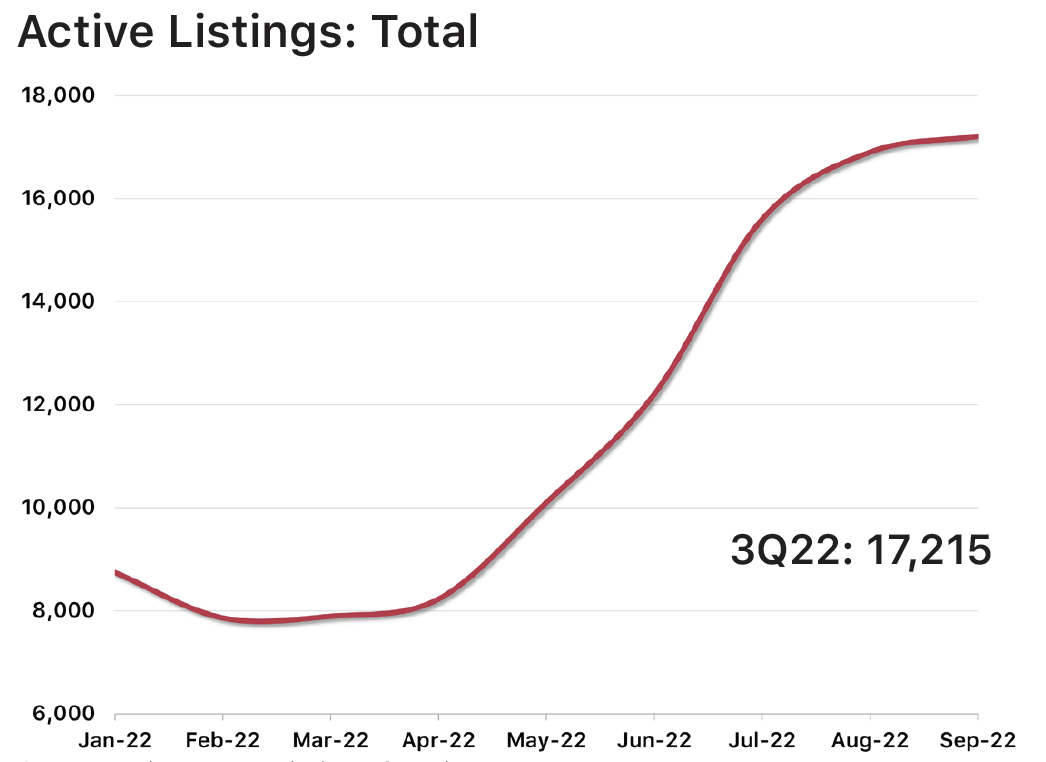

Active Listings

Source: Atlanta Association of Realtors

Source: Atlanta Association of Realtors

The number of active listings (new and resale homes available for purchase) continued to improve during Q3, due largely to the pullback in demand from potential homebuyers due to high home prices and rising mortgage rates. The number of active listings increased by more than +41% (+5,000 listings) during Q3, bringing the months’ supply of available homes to 2.1 months. While this is certainly an improvement as compared to Q2 and 2021 levels, it should be noted that the current supply is still well below the “normal” range for this market of 6-8 months.

Housing Starts

Source: Metrostudy

Total annualized starts activity declined for the fourth consecutive quarter in Q3, falling -6.8% over the last 12 months. SFD and SFA starts declined by -6.9% and -6.7%, respectively, during Q3 and have declined by -23.8% and -17.3% over the last 12 months. Despite the recent decline, SFA starts remain well above (+27.5%) their pre-pandemic level as homebuilders are increasingly turning towards this product type as a way to maximize project density, reduce construction costs, and offer more affordable product. We expect starts activity to continue to reflect homebuilders’ diminished confidence given consistently high home prices and mortgage rates.

Source: Metrostudy

Across the MSA, the $300K-$399K price range continues to capture the largest share of housing starts (32.5%), although the margin separating this price tier from the next ($400K-$499K: 29.1%) is shrinking quickly. In fact, an astonishing 23.4% of new homes started over the last 12 months are being listed above the $500K price point as compared to just 13.1% in the preceding 12-month period. Cooling demand could bring about a mild resurgence of housing starts in the lower price tiers over the next 6-12 months, but high land and construction costs combined with relatively low supply will likely keep the vast majority of housing starts in the upper price tiers.

New Home Closings

Source: Metrostudy

New home closings declined on both a quarterly and annual basis during Q3, declining by -3.5% and -12.2%, respectively, over the last 12 months. SFD closings fell by -3.9% during Q3 and are down -14.0% on an annual basis; SFA closings were largely aligned with their detached counterparts, declining by -2.4% on a quarterly basis and by -6.3% on an annual basis. High home prices and increasing mortgage rates have had a significant impact on the number of Atlanta households that can afford to purchase a new home, and closings will continue to reflect diminished buyer confidence in the current market.

Lot Deliveries

Source: Metrostudy

The number of new home closings fell for all price segments below $400K during Q3. New home closings below $400K declined by -36.9% during Q3, whereas new home closings above $400K increased by +50.4% over the same period. In fact, new home closings above $400K represented 48.5% of all new home closings across Metro Atlanta in Q3, a significant jump from the 28.3% share these upper price points represented in 2021. We expect prices to come down slightly over the coming months due to waning demand, but high construction costs and limited inventory will prop pricing up in the short term.

Source: Metrostudy

Source: Metrostudy

Despite increasing land development costs and extended delivery timeframes, annualized lot development across the Atlanta MSA increased during Q3. Total lot deliveries increased by +2.3% from Q2 and by +5.4% over the last 12 months. Detached lot deliveries grew by +4.5% from Q2 but remain relatively unchanged from 12 months ago; attached deliveries declined slightly from Q2 (-2.7%) but remain significantly higher than they were 12 months ago (+20.1%). While demand for detached lots will always outweigh demand for attached lots in this market, we expect attached lots to represent an increasing share of lot deliveries as developers and builders aim to maximize density and offer more affordable product. At the end of Q3, there were 37,431 lots in active development across the MSA, a +4.1% increase from 12 months prior. The majority of lots in active development fall into the Excavation category, indicating they are 6-18 months from delivery.

Inventory & Supply

Source: Metrostudy

Despite the uptick in SFD lot deliveries on both a quarterly and annual basis, SFD VDL inventory fell by -2.2% during Q3 and is down -8.9% from 12 months ago. Because the decline in new SFD home closings over this period was more significant than the decline in SFD VDL inventory, the months’ supply rebounded modestly. SFD VDL supply has improved by +6.9% from the end of Q2 and by +19.7% from 12 months ago, reaching 23.1 months at the end of September.

Source: Metrostudy

The notable increase in SFA lot development and deliveries over the last 12 months has worked to balance the increasing demand for this product type as builders look for ways to maximize project density and offer smaller, more affordable homes. The inventory of SFA VDLs declined by -9.4% during Q3 but remains relatively unchanged (-1.7%) from inventory levels 12 months ago. Because demand for this product type has proven to be a bit more resilient than its SFD counterpart, the months’ supply of SFA VDLs remains near record low levels.

Market Leaders

Source: Metrostudy

Gwinnett continues to lead the MSA with 3,636 new homes started over the last 12 months. The list of top performing counties is mostly unchanged from Q2 with Cherokee, Cobb, S Fulton, and Henry coming in behind Gwinnett to round out the top five. Of the 23 counties analyzed, 19 (83%) of them experienced year-over-year declines in starts during Q3. The most notable increases were from Fayette (+16.2%) and Dawson (+18.8%); the most notable declines were Dekalb (-41.2%) and Forsyth (-42.2%).

Source: Metrostudy

Gwinnett led the MSA in new home closings during Q3 with 3,483. The rest of the top five was rounded out by Cherokee, Forsyth, Henry, and Dekalb which combined for 7,261 total new home closings. Only 8 of the 23 counties analyzed experienced an increase in annualized closings during Q3, led by +33.3% and +22.4% increases in Fayette and Dawson, respectively. The counties with the most notable annualized declines over the same period were Rockdale (-42.7%) and Clayton (-48.6%).

Source: Metrostudy

Gwinnett led the Atlanta MSA in lot development, delivering 4,165 lots over the last 12 months. Cherokee, S Fulton, Cobb, and Jackson counties filled out the top five, accounting for 6,779 combined lot deliveries over the last 12 months. 11 of the 23 counties analyzed increased annualized lot deliveries during Q3, led by Rockdale (+144.8%), Bartow (+139.2%), and Jackson (+132.0%). Interestingly, the 11 counties that increased in lot deliveries significantly increased - by double digit percentages. The most notable declines in lot deliveries over this period include Carroll (-100.0%), Spalding (-94.8%), and Dekalb (-75.8%).

Carlton North - Lennar (Source: Realtor.com)

Renaissance at South Park - Rocklyn Homes (Source: NewHomeSource.com)

Source: Metrostudy/Zonda, Jackson County Tax Assessor, Fulton County Tax Assessor

* Sales data not yet available, average price is estimated based on the current list price of completed specs.

The list of top performing (starts) communities has undergone a drastic transition from Q2, and 10 new communities overtook the top spots during Q3. Development and new home construction activity continues to be heavily influenced by the availability and price of land, and as such we are seeing an increasing amount of activity occurring in more distant suburbs such a Jackson, Cherokee, and Hall.

3 of the top 5 communities are townhome communities (4 of the top 10).

Of the top 10 communities, 7 of them are located 30+ miles from the urban core (3 of these 7 are 40+ miles).

None of the top 10 communities have more than a 6-month supply of VDLs remaining, indicating that they will likely sell out before the end of 1Q23.

The reasonably attainable pricing of homes in these communities (mid $300s - mid $400s) is helping builders keep sales rates high despite high home prices and mortgage rates.

Source: Metrostudy

The changes in builder activity during Q2 was certainly interesting; builders either experienced a sharp increase in closings or a significant decrease in closings with only builder staying somewhat consistent with their Q1 level. D.R. Horton continues to dominate the Atlanta MSA in both starts and new home sales, combining for 720 closings across all their product lines in Q2 (an +11.1% increase from Q1). Other builders with notable upticks in closings include Starlight Homes/Ashton Woods (+47.2%), Dan Ryan Builders (+35.1%), and Meritage Homes (+33.1%). Nearly half of these builders went in the opposite direction, however; Lennar, Rocklyn Homes, and Pulte Homes all posted double digit percentages decreases from Q1. While we can expect all builders to move cautiously over the coming months, both in terms of lot development and housing starts, it’s reasonable to assume that larger regional and national homebuilders will fare a bit better in light of the general uncertainty confronting the housing market at this time.

Conclusion

In the introduction, we used a “glass half empty/full” metaphor to describe both the national and Atlanta economies and have provided evidence in this report that could support opposing views of the severity and longevity of challenges we will face as we close out 2022 and look ahead to 2023. When considering metrics like sticky inflation and high prices, we find ourselves asking two questions: How long will this last? And will it get worse before it gets better?

While there is no way to be sure, the St. Bourke team certainly leans towards a “glass half full” mentality when considering Atlanta’s housing market and broader economy. Despite the very real pains we are feeling brought on by inflation, rising costs, clogged supply chains, and labor shortages, we have compiled and analyzed ample evidence that supports our belief that Atlanta’s diverse and resilient economy will continue to weather the elevated levels of uncertainty we are facing.

Regarding Atlanta’s housing market specifically, we are undoubtedly feeling the pinch of unaffordability, diminishing demand, and sliding builder confidence; it certainly feels like we have fallen a long way from the chaotic and frenzied conditions we experienced in early and mid-2021. It is St. Bourke’s view, however, that the unsustainable level of home price growth and inventory shrinkage during that period was doing more long-term harm than good to Atlanta’s housing market, and that what we are feeling now is a temporary – and necessary – recalibration that will ultimately allow demand to rebound. It’s important to remember that Atlanta has a high concentration of Millennials approaching or currently in the “home buying sweet spot” (approximately 900K residents), and high home prices and mortgage rates are having a disproportionate impact on the young buyers that comprise the two largest buyer segments – first time and first move-up homebuyers.

The underlying fundamentals remain strong and should work to buoy Atlanta’s housing market despite the general market uncertainty. Atlanta’s housing market will continue to benefit from demographic tailwinds (strong population growth and in-migration, high concentration of Millennials, strong wage growth), which should work in come capacity to insulate the housing market from total stagnation. Despite significant home price growth over the last 12-18 months, Atlanta remains one of the most affordable major Metros in the country and continued corporate expansions and relocations will continue to attract well-paying jobs and residents to this area.

At the end of the day, Atlanta is still facing a critical supply/demand imbalance; simply put, Atlanta has more people who want to buy houses here than we have houses to sell them or lots to build them on. This baseline leaves us feeling confident that the Atlanta housing market will benefit greatly from so much pent-up demand once home prices and mortgage rates return to more palatable levels.

For information about market research & reporting, including custom market reports, please contact Katie Fidler at katief@stbourke.com.