Year End 2022

National Housing Market Analysis

National Housing Market Analysis

Sentiment around the national economy was admittedly bleak headed into Q4: mortgage rates had jumped by 100 basis points during Q3 alone, the stock market had reached its lowest point of the year, consumer sentiment had hit the lowest level ever recorded, and inflation had yet to meaningfully respond to the Fed’s aggressive actions to slow the rate of increase. From a housing perspective, builder confidence had sunk into the negative range for the first time since the onset of the pandemic, affordability had declined -30% on the year, and key inputs like starts and home sales had just fallen below their 20-year average levels. Fears of a potential 2023 recession were heightened and, arguably, more justified than ever before.

Fortunately, however, the U.S. economy demonstrated its resilience yet again in Q4. The economy added an additional +880K jobs, the rate of inflation began making more meaningful monthly declines, the stock market rebounded modestly from Q3 lows, and consumer sentiment showed signs of stabilization.

“Mortgage rates are a really critical path to the housing market in the year ahead. We are watching to see affordability gradually improve. That should breathe some life back into the market.”

Jeff Tucker

Senior Economist, Zillow

Declining starts and sales dominated headlines related to the housing market, but there were bright spots in Q4 as well. Mortgage rates seemingly hit their peak and declined steadily over the last 6 weeks of the year, starts and sales rebounded strongly in December, and we saw evidence of some much-needed price growth deceleration in both new and existing homes. The following factors had a significant impact on the national housing market in Q4:

Mortgage Rates: Mortgage rates continued the upward trajectory established mid-year, peaking just above 7% in early November following additional rate hikes from the Federal Reserve Bank. At more than double the rate that homebuyers were able to secure just 9 months ago, high interest rates have added tens of thousands of dollars to lifetime borrowing costs and worked to further erode affordability. Fortunately, mortgage rates trended downward the last 6 weeks of the year and are expected to decline further (in line with inflation) as the year progresses. The psychological impact of watching rates climb from 3% to 7% in a matter of 6 months cannot be overstated, and we expect the reversal of this same psychology to play a role as mortgage rates slide closer to long-term average levels (5%).

Affordability: Mortgage rates were just one factor impacting affordability during Q4. Total housing supply remains critically low, which has kept prices at or near record-high levels in most major markets despite the dramatic pullback in demand seen in the second half of 2022. While price growth has certainly slowed, we have yet to see any real evidence of a pricing retraction, and most markets saw home prices increase during 2022 as compared to 2021. Affordability was also negatively impacted by low levels of mortgage credit availability during Q4 as lenders tightened their standards due to the general economic uncertainty and the increasing risk of defaults and foreclosures.

Rebounding Activity: The housing market responded almost immediately to declining inflation and mortgage rates at the end of 2022. Single-family starts jumped nearly +10% from November to December, new home sales increased modestly, new and existing home prices showed continued signs of moderation, and existing home sales flattened after 11 straight months of decline. These positive trends have continued thus far in 2023, and despite the challenges that still lay ahead, we have begun to see a moderate shift in sentiment from both home builders and home buyers in light of these positive economic indicators.

The data provided in this report has been interpreted and analyzed through the lens of residential land development and home construction. Understanding key metrics and their implications is essential to making informed business decisions and remaining flexible as an organization, especially during these unprecedented times.

Sources: U.S. Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, National Association of Homebuilders, National Association of Realtors, Mortgage Bankers Association, Zillow, Metrostudy/Zonda

“Price discovery is happening quickly in the new home market and housing demand in many metros across the country is showing signs of either stabilizing or improving compared to the second half of last year.”

Ali Wolf

Chief Economist, Zonda

KEY MACROECONOMIC METRICS

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Employment remained a bright spot in the U.S. economy through Q4, and the country netted +5.3M jobs over the last 12 months with the largest gains coming from the Healthcare and Leisure & Hospitality sectors. The unemployment rate fell from 4.0% in January to 3.5% in December, the lowest level achieved since February 2020. Effects of the intentional economic slowdown by the Federal Reserve Bank in response to high inflation became more evident during Q4 when monthly job creation averaged just below 300K/month, as compared to the 540K/month average in the first 3 months of the year.

Source: Bureau of Labor Statistics

Inflation declined steadily through the second half of 2022 as the effects of the Fed’s inflation-fighting measures began to materialize. The inflation rate peaked at 9% in June but ended the year nearly 250 basis points lower at 6.5%. Inflation is expected to continue this downward trend through 2023, and many economist believe that the inflation rate will decline to 3-4% over the next 12 months. Note that this projection remains above the Fed’s target of 2-2.5%, so we should not expect any rate cuts in 2023.

Source: Bureau of Labor Statistics

Unlike its related counterpart inflation, the CPI has yet to pivot and begin its descent to more normal levels. However, we did see CPI flatten during Q4, a welcome sign that consumer prices for goods and services have begun to stabilize, and the measure declined very slightly from November to December (-0.08%). CPI is expected to increase during 2023, however most economists project that the annual increase will reflect a more typical growth rate of +3% as compared to the +6.5% growth we saw in 2022.

Source: Bureau of Economic Analysis

The year-over-year change in wages & salaries declined steadily during 2022, falling from +10.1% annual growth in January to +5.3% annual growth in December (although still well above the 20-year average of +4.2% annual growth). While a moderation in the increase of wages & salaries in largely intentional and an indication that the Fed’s aggressive actions to cool the economy and curb inflation are taking effect, consumers continue to pay (literally) for the imbalance between inflation (+6.5%) and wage growth (+5.3%).

Source: University of Michigan Surveys of Consumers

Consumer sentiment followed a downward trajectory through the first half of 2022 as concerns regarding inflation and a potential recession became more prevalent. Consumer sentiment bottomed out at 50.0 in June when the inflation rate peaked above 9%, representing the lowest level ever recorded. Consumer sentiment improved steadily through the second half of the year based on positive inflation reports and declining prices of key consumer goods like gasoline, and the metric increased to 59.7 by the end of December. Consumer sentiment should continue to improve in line with inflation and other economic metrics during 2023, and we expect it to return to 2021 levels over the next 12 months.

Source: YCharts

Source: YCharts

Both the S&P 500 and NASDAQ declined consistently throughout 2022, losing -20% and -35%, respectively, over the last 12 months. The S&P 500 rebounded modestly during Q4 on the back of improving inflationary metrics and consumer sentiment, gaining +7% over this 3-month period. The NASDAQ, however, did not mirror the movement of the S&P 500; a wave of tech industry layoffs from major players like Microsoft, Twitter, and Amazon suppressed any potential for a similar rebound, and the NASDAQ ultimately lost an additional -5% during Q4. While we expect both indices to remain above the lows established in 2022, we believe that the S&P 500 will continue to outperform the NASDAQ given the multitude of headwinds faced by tech companies in the coming months.

KEY HOUSING METRICS

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

In an effort to further curb combat sticky inflation, the Federal Reserve Bank increased the Federal Funds Rate an additional +150 basis points during Q4. The +425-basis point increase over the course of 2022 (x7 individual rate hikes) was the largest annual increase since the 1980’s and had a significant impact on mortgage rates. After peaking at 7.08% in early November, 30-year mortgage rates responded to softening inflation and declined to 6.42% by the end of December. Mortgage rates are expected to decline further, albeit modestly, over the coming months assuming inflationary measures continue their downward trajectory. Many economists project that rates will stabilize between 5-6% during 2023, which is in line with the long-term average mortgage rate of 5%.

Source: Mortgage Bankers Associations

The MCAI, which measures how difficult it is to obtain a mortgage based on current lending requirements, declined for much of 2022 before leveling out in Q4. Overall, the index fell by -18% during 2022. The decrease is a reflection of lenders’ increased borrowing requirements as they grappled with rising interest rates and the growing likelihood of future defaults and foreclosures should the U.S. indeed fall into a recession. We expect the MCAI to improve in line with inflation over the course of 2023.

Source: National Association of Realtors

Affordability deteriorated considerably during 2022, declining by -33% over the last 12 months due to a combination of sticky home prices, increasing mortgage rates, and low inventory. The pullback in buyer demand led to some minor fluctuations in affordability in the second half of the year, but the index has not breached the baseline level of 100 since August. While we do expect affordability to improve modestly during 2023, the extreme under supply of available homes will ensure that affordability remains a critical issue.

Source: National Association of Homebuilders

Builder Confidence fell below the baseline level of 50 in 2022, indicating that the outlook is more negative than positive, as mortgage rates approached (and quickly surpassed) 6% in July and August. Easing inflation and a healthier supply of available homes should have positive impacts on homebuyer demand over the next 12 months, and we expect Builder Confidence to rebound above the baseline level by the end of the spring selling season.

Source: U.S. Census Bureau

Annualized U.S. residential construction spending reflected the general pullback in construction activity seen in the second half 2023. The rate of decline, however, flattened considerably in November and December, and residential construction spending actually ended the year +2% higher than 2021. We expect residential construction spending to rebound above the $900B level as homebuyer demand begins to re-emerge in 2023.

HOUSING METRICS - NEW HOMES

Source: U.S. Census Bureau

Total building permits declined by -30% during 2022, led by a -35% decline in SF permits and a -23% decline in MF permits over the last 12 months. While homebuilders continue to grapple with high construction costs and suppressed buyer demand, we see evidence of improving conditions (declining construction inputs, home prices, and mortgage rates as well as increasing buyer traffic and mortgage applications) and expect permit activity to rebound above the 1.5M mark as the year progresses.

Source: U.S. Census Bureau

Annualized SF housing starts fell dramatically through most of 2022, bottoming out at 817K in November before rebounding to 909K to close the year (+9%). Overall, SF starts declined by -25% in 2022 as both builders and buyers reacted to high prices and interest rates. SF completions were much steadier over this period, however; completions remain well above the 20-year average and were largely unchanged from the prior year. We expect annualized starts to rebound above 1M as supply/demand metrics continue to improve during 2023.

Source: U.S. Census Bureau

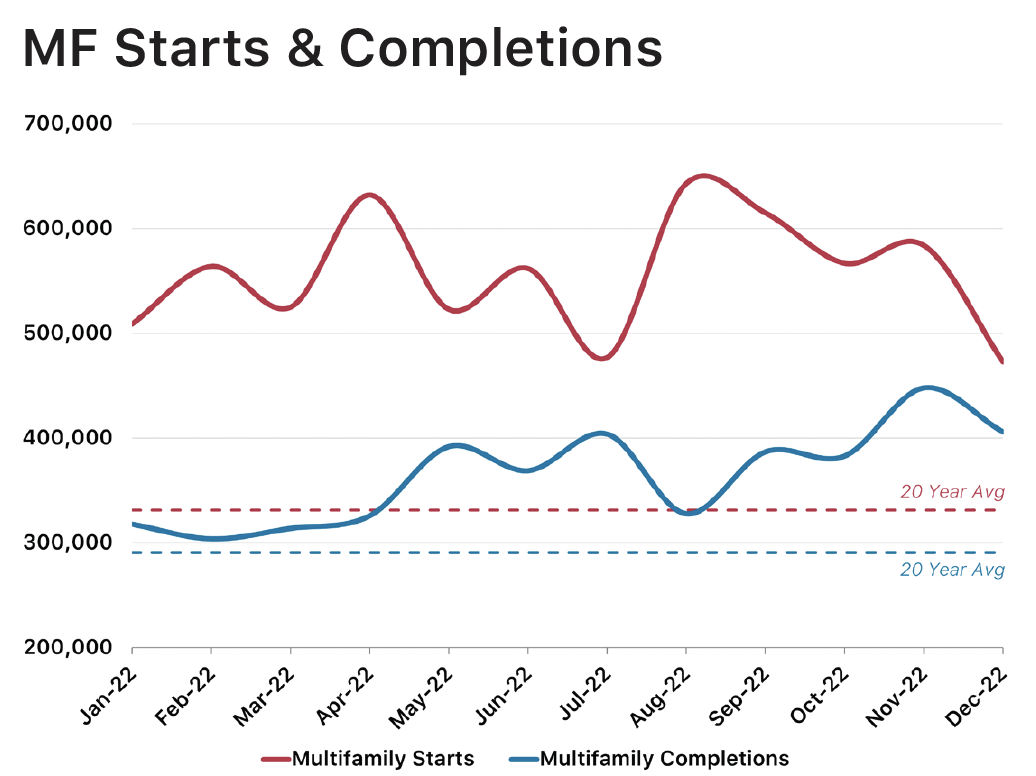

MF construction was less impacted by rising interest rates than its SF counterpart during 2023. MF housing starts were on track to increase on an annual basis following Q3 (+10%); however, this trend reversed during Q4 (-23%) and MF starts ultimately fell by -22% during 2022. Alternatively, MF completions maintained an upward trajectory through the entire year and ultimately improved by +33% by December. We expect both MF starts and completions to remain above historic levels given the considerable number of households that are being forced to remain renters based on home prices and availability.

Source: U.S. Census Bureau

New SF home sales declined steadily through the first half of 2022 before leveling out and increasing modestly to close the year, improving by +12% during Q4 but declining by -27% over the last 12 months. While we expect high home prices and interest rates to continue to impact demand in 2023, we believe that interest rates will decline and home price growth will moderate as inflation and supply return to more normal levels. Based on improving builder sentiment and economic metrics, we expect new SF home sales to rebound above the long-term average level before the end of 2023.

Source: U.S. Census Bureau

The median new home sale price peaked at $491K in October as mortgage rates approached 7% for the first time since the early 2000’s but fell sharply back to $442K by the end of the year. Overall, new SF home prices increased by +8% during 2022, a modest deceleration from the +10% growth seen in 2021. Home prices remain elevated despite significantly lower demand due to the critical lack of supply facing most major U.S. metros as well as stubbornly high construction and labor costs.

Source: U.S. Census Bureau

The pullback in demand over the last 12 months translated directly to an increase in new home inventory, which returned to normal levels for the first time in two years. Despite falling by half a percentage point during Q4, the number of new homes for sale increased by +19% during 2022. This overall improvement in inventory combined with decreased sales activity lifted the months’ supply from 5.7 months in January to 9.0 months at the end of the year.

HOUSING METRICS - EXISTING HOMES

Source: National Association of Realtors

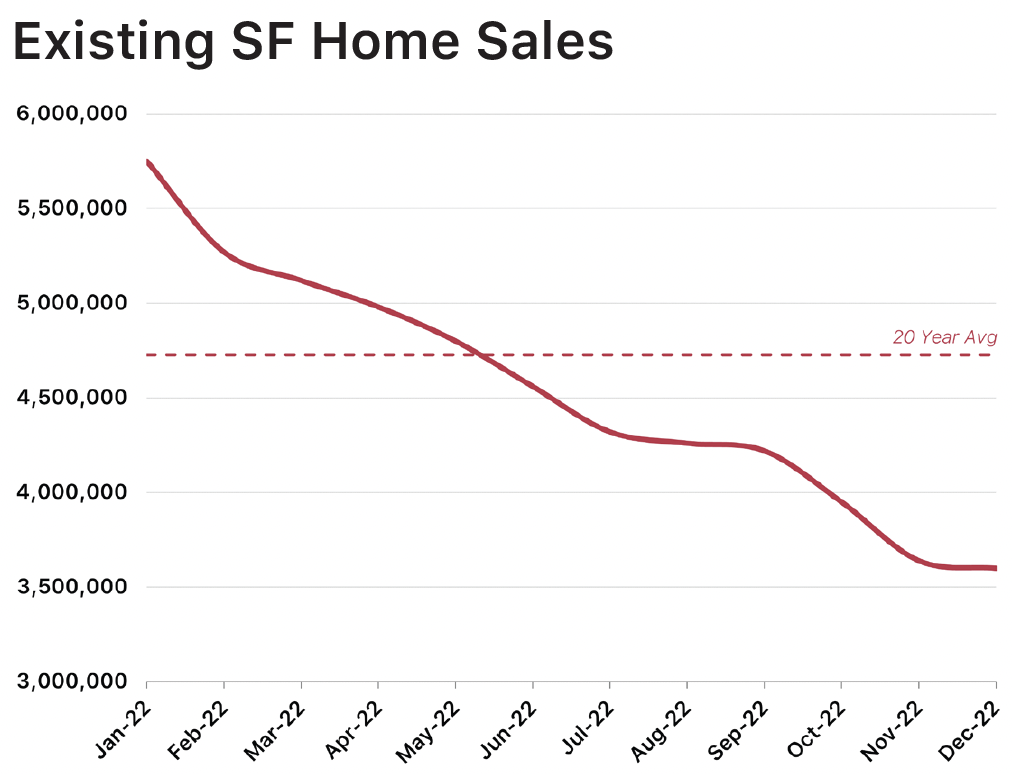

Existing SF home sales fell below the long-term average level in June before bottoming out at 3.6M in December, a significant -34% decline over the last 12 months. Sales activity remains nearly -24% below the historical average (4.7M) due largely to high home prices, rising rates, and lack of available inventory. While we expect demand, and therefore sales activity, to improve in line with inflationary measures during 2023, the lack of supply will continue to dampen activity in the short and medium term.

Source: U.S. Census Bureau

Although the existing home supply improved slightly from 1.6 months in January to 2.9 months by the end of December, supply remains critically low. The current level is significantly below the 20-year average of 5.5 months, and current owners have very little incentive to sell and move at present as they would likely pay an inflated price for their next home and obtain an interest rate considerably higher than what they currently have. We anticipate that the lack of supply will continue to stifle sales activity during 2023 and beyond.

Source: National Association of Realtors

Despite the decline in demand during 2022, the median existing home sale price was relatively unchanged over the past year. The median price ended the year at $373K, +2% higher than where it started the year. The critical lack of existing home supply (below) will continue to prop up existing home prices in the short and medium term, and we expect existing home prices to return to more normal levels in 2023 as inflationary measures improve and demand begins to return.

HOUSING METRICS - RENTALS

Source: U.S. Census Bureau

Because high home prices and borrowing costs have forced many would-be homebuyers to remain renters, the rental vacancy rate has maintained a historically low level for the last 18 months. The vacancy rate was relatively unchanged during 2022, increasing from 5.6% in December 2021 to 5.8% in December 2022. We expect the vacancy rate to inch closer to pre-pandemic levels (6-7%) as the year progresses as the for-sale housing market begins to loosen, however we do not anticipate a return to historical vacancy levels (8.5%) in the foreseeable future.

Source: U.S. Bureau of Economic Analysis

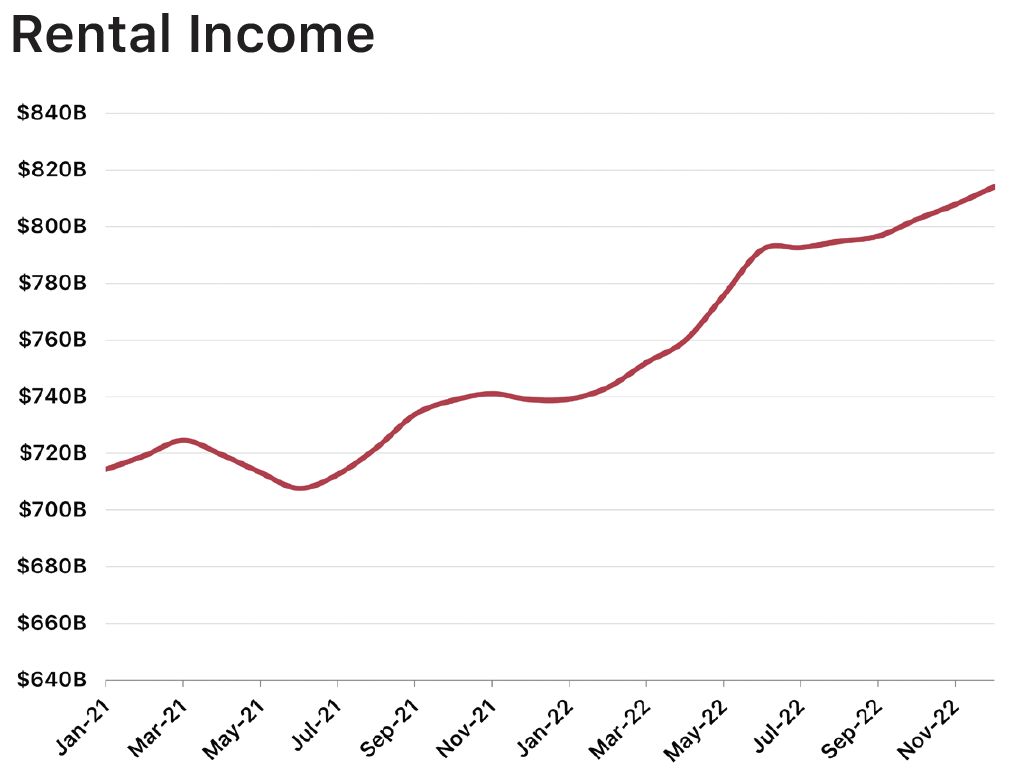

The modest deceleration in median asking rents seen during Q4 was not reflected in the overall rental income figures reported throughout 2022. In fact, total rental income increase by +2% during Q4 and by +10% over the last 12 months (compared to +4% growth in 2021). As with asking rents, we expect that quarterly and annual growth will return to more normal levels as economic and inflationary measures improve and the for-sale housing market begins to loosen.

Source: U.S. Census Bureau

The median asking rent peaked at $1,334 at the end of Q3 before declining slightly to $1,322 by the end of Q4 (the -1% decline in Q4 represents the first retraction in asking rents since 3Q21). Low vacancy rates, exacerbated by high home prices and borrowing costs impeding some households’ natural progression from renting to homeownership, and sticky housing inflation metrics led to an overall +10% increase in median rent prices during 2022. Persistent demand for rental units will keep prices from backsliding too far, although we expect quarterly growth to return to more normal levels (+1% quarterly growth) in 2023.

Conclusion

We entered 2022 hopeful that the significant momentum built during the post-pandemic homebuying frenzy would carry into the new year, although we did anticipate construction and home price growth to return to more sustainable levels as the year progressed. In the conclusion of St. Bourke’s 2021: Year in Review report, we predicted that declining affordability, low inventory, and easing supply chain issues would be the driving factors behind the national housing market in 2022. And we got it right in many regards: the median sale price for both new & existing homes increased further during 2022 (although at a slower pace than seen in 2020 and 2021), and the Affordability Index fell an additional -29% over the last 12 months. And while the inventory of new homes rebounded above the long-term average level as the year progressed, the inventory of existing homes – which account for 80-85% of all sales activity – remains -30% below normal levels. Lastly, construction labor issues eased slightly (19K average monthly growth in 2022 as compared to 16K in 2021) and the rate of growth of construction materials pricing slowed by -60% (less than half the increase seen in 2021).

What we did not account for was the impact that inflation, or rather the Federal Reserve Bank’s response to increasing inflation, would have on the general economy and housing market. In an aggressive effort to curb and reduce inflation, the Federal Reserve Bank raised the Federal Funds Rate 7 times during 2022. This combined 425-basis point increase, which represents the largest annual increase to the Fed Funds Rate since the 1980’s, caused mortgage rates to skyrocket. These increased rates, which have the greatest impact on first-time and first-move up homebuyers, severely decreased the purchasing power of potential buyers and disqualified many would-be buyers from the market.

“It seems we have already reached the bottom of the low home sales activity. And with mortgage rates stabilizing near 6%, we expect the housing market to turn around in 2023... and rebound in 2024.”

Nadia Evangelou

Senior Economist & Director of Forecasting, NAR

Fears of a forthcoming recession increased as the year progressed, becoming louder and more pervasive in May and June when inflationary measures showed that the Federal Reserve Bank’s attempts to slow inflation had not yet taken effect. The housing market, which had already begun to cool due to persistent pricing and inventory issues, slowed further during this period as developers and homebuilders prepared for worsening conditions.

Fortunately for the national economy, the Federal Reserve Bank’s efforts to curb inflation finally took hold towards the end of the summer, and the inflation rate decreased every months from August – December. And while we are not out of the woods yet, more and more economic indicators, including Q4 GDP growth of +2.9%, are pointing towards a “soft landing” for the U.S. economy in 2023 rather than a steep nose-dive into a painful recessionary period.

“The bottom line is that there really isn’t a likely scenario that leads to inventory levels approaching historically normal number in 2023, which means that prospective homebuyers are still going to have to work hard to find something to buy.”

Rick Sharga

Executive Vice President of Market Intelligence, ATTOM Data

The St. Bourke team continues to support a “glass half full” mentality in regards to the national economy and housing market, and we believe that key metrics like housing inventory, sales activity, and price growth will return to more normal levels as the year progresses. We expect the following factors to drive the national housing market in 2023:

Mortgage Rates: The 30-year mortgage rate jumped from 3.22% in early January to 5.01% in April before peaking at 7.05% in November. Fortunately, mortgage rates decreased in line with inflation over the final months of 2022, and many economists and financial experts predict that mortgage rates will decline further during 2023. Given the extreme amount of pent-up demand from Millennials aging into homeownership and Baby Boomers aging into retirement/relocation, we believe that demand will begin to rebound in earnest once interest rates get closer to the long term average of 5%. Current estimations from institutions such as the Mortgage Bankers Association and National Association of Realtors are projecting 30-year mortgage rates to stabilize between 5-6% by the end of 2023.

Pent-Up Demand: Throughout this report, we purposely used phrases like “suppressed demand” to denote that demand for housing still exists despite declining starts & sales figures in 2022. In fact, one could argue that demand for housing is stronger than ever before. Americans did not stop wanting (or needing) to purchase homes when price and interest rate growth accelerated; many buyers, especially first-time and first-move up buyers, simply could no longer afford to do so. Those buyers that were unable to secure a home during the initial buying frenzy of 2020/2021 and/or those priced out of the market in 2022 still want and plan to purchase a home – they are just waiting for economic conditions to allow them to re-enter the market. And when you consider that millions more Millennials and Baby Boomers have aged into homeownership and retirement years, respectively, since this onset of these abnormal market conditions, it becomes clear that demand remains. We expect an increasing share of this pent-up demand to be unleashed as interest rates continue to decline towards the long-term average level (5.0%), although low supply and affordability will continue to have a fairly significant impact on demand for the foreseeable future.

Low Housing Supply: The U.S. has faced a national housing shortage since coming out of the Great Recession more than a decade ago. The pace of new home construction has failed to keep up with population growth, and recent estimates put the country’s housing shortage between 4 – 5.5 million units. The onset of the pandemic in 2020 and ensuing explosion of the housing market only exacerbated the country’s housing shortage, and the level of available inventory was still -33% below pre-pandemic levels as of December 2022. We should see this number improve as pricing and interest rates continue to moderate during 2023, but current owners have little incentive to sell and move at present given they would be subject to the same inflated prices and mortgage rates plaguing other would-be buyers. While we expect the supply level to improve gradually during 2023, it is unlikely that it will return to pre-pandemic levels in the short or medium term given the significant amount of demand and ongoing affordability concerns.

2023 will be remembered as a pivot point in the story of the national economy with the first several months of the year providing a solid indication of the path ahead. The St. Bourke team is optimistic that the Federal government’s inflation-fighting measures will continue to produce positive results and that employment impacts will remain relatively limited and isolated within certain sectors of the economy. We have already seen positive indicators of returning demand and rebounding production from our investment and homebuilding clients thus far in 2023, and we feel reasonably confident that the national housing market will benefit from the significant level of pent-up demand once mortgage rates return to more palatable levels.

For information about market research & reporting, including custom market reports, please contact Katie Fidler at katief@stbourke.com.